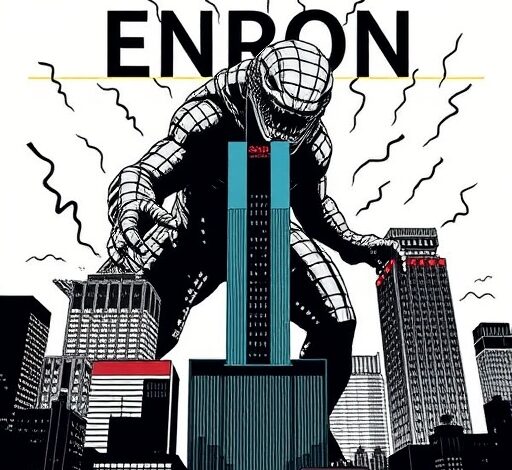

Enron Partnership was once a worldwide energy organization situated in Houston, Texas, that developed to unmistakable quality during the 1990s. It was proclaimed as an image of corporate achievement and development, however its devastating defeat in the mid 2000s became quite possibly the biggest corporate embarrassment ever. Enron’s emotional ascent and fall have been the subject of extraordinary examination, fights in court, and far reaching public premium, especially in view of the job of bookkeeping firm Arthur Andersen in the embarrassment and the effect on the economy and the existences of representatives and financial backers.

The Ascent of Enron

Enron was established in 1985 by Kenneth Lay as’ Lay-Highway Flammable gas Organization, which later converged with InterNorth, an oil and gas pipeline organization. At first, the organization zeroed in on gaseous petrol exchanging, yet under the authority of President Jeffrey Skilling and CFO Andrew Fastow, Enron’s activities extended quickly into numerous areas. It broadened into energy exchanging, broadband, and, surprisingly, worldwide business sectors, situating itself as “another economy” organization. By the 1990s, Enron had turned into a key part in the energy business, especially in the exchanging of energy agreements and subordinates.

What put Enron aside during its pinnacle years was its production of an exceptionally complex monetary model. Using unique reason elements (SPEs), Enron had the option to get obligations off its asset report, causing the organization to show up as more beneficial and safer than it really was. Its stock value took off, and it turned into a number one on Money Road, with financial backers pouring in cash, having faith in the organization’s capacity to improve and convey huge returns.

Enron likewise stood out as truly newsworthy for its emphasis on corporate culture, advancing a high-risk, high-reward disposition inside its representatives. The organization’s forceful exchanging strategies, dependence on complex monetary instruments, and cultivating of a “succeed no matter what” culture prompted fast achievement, yet in addition sowed the seeds for calamity. Enron was over and over named quite possibly the most imaginative organization in America, frequently positioning high on Fortune’s “Generally Respected” list.

The Defeat: Disentangling of Enron’s Realm

Enron’s fall out of favor started in 2001, and it immediately became obvious that the organization’s monetary achievement had been based on a snare of untruths, misrepresentation, and monetary distorting. A few key variables added to the organization’s breakdown:

- Bookkeeping Extortion and the Job of Enron’s Chiefs: Enron utilized forceful bookkeeping strategies to blow up its benefits and conceal its obligation. One of the most basic issues was the formation of specific reason elements (SPEs), which permitted Enron to keep monstrous measures of obligation off its monetary record. This caused the organization to show up substantially more productive than it really was, misleading financial backers, investigators, and controllers. Enron’s leaders, including CFO Andrew Fastow, assumed a focal part in organizing this double dealing.

- The Job of Arthur Andersen: The bookkeeping firm Arthur Andersen was complicit in Enron’s false exercises. As Enron’s examiner, Arthur Andersen neglected to distinguish the misrepresentation as well as annihilated proof when the organization’s destruction appeared to be approaching. This brought about the possible arraignment and disintegration of Arthur Andersen, which was one of the biggest review firms on the planet at that point.

- Stock Value Control: As reality with regards to Enron’s monetary practices started to surface, its stock cost imploded. What followed was a progression of disclosures about the organization’s misleading budget summaries, setting off an examination by the Protections and Trade Commission (SEC) and ultimately prompting the organization’s liquidation in December 2001.

- Worker Misfortunes and Corporate Culture: Enron representatives, who had been urged to put their life reserve funds in Enron stock through retirement plans, were left crushed. As the organization’s stock dove, a huge number of workers lost their positions and their retirement investment funds. This demolished many lives as well as started public shock about corporate misbehavior and the absence of responsibility in the business world.

Enron sought financial protection in late 2001, owing leaders almost $40 billion. The organization’s stock, when worth more than $90 per share, dropped to simple pennies, and a large number of representatives were left without occupations or reserve funds. The chapter 11 of Enron had sweeping impacts on the energy market, the bookkeeping calling, and corporate administration in the US.

Lawful Outcomes and Consequence

The Enron outrage set off a flood of lawful activities, both crooked and common, including chiefs, workers, and different gatherings associated with the extortion. In 2006, Enron’s previous Chief, Jeffrey Skilling, was censured on different charges of safety, mutilation, trick, and insider exchanging, and was condemned to 24 years in jail (however his sentence was consequently decreased). Kenneth Lay, the organizer behind Enron, was also indicted on charges for duplicity, right now he passed on from a coronary episode before he could be scolded.

The breakdown of Enron also incited colossal changes in U.S. rule and corporate association. In 2002, the U.S. Congress passed the Sarbanes-Oxley Act, which was expected to work on the exactness and steadiness of corporate monetary detailing and increase commitment with respect to pioneers.The law commanded stricter oversight of public organizations, including the execution of inside controls, expanded straightforwardness in budget summaries, and the production of free review boards of trustees.

Enron’s Heritage

The Enron embarrassment fills in as a useful example about corporate ravenousness, dishonest way of behaving, and the results of uncontrolled power in the business world. It likewise featured the requirement for more grounded administrative structures and responsibility in the monetary and corporate areas.

Today, Enron is an image of corporate misbehavior, and its ruin has lastingly affected both the business world and administrative strategies. The organization’s story keeps on being concentrated on in business colleges and graduate schools as an instance of how unrestrained desire and exploitative corporate way of behaving can prompt horrendous results.

Questions and Replies

Q: How did Enron’s bookkeeping rehearses add to its ruin?

A: Enron utilized forceful bookkeeping practices to conceal its obligation and expand its benefits, principally using particular reason substances (SPEs). These elements permitted Enron to keep billions of dollars in the red off its accounting report, causing the organization to show up more productive and safer to financial backers. This misleading bookkeeping practice deceived experts, financial backers, and controllers about the genuine monetary wellbeing of the organization.

Q: Who was answerable for the Enron embarrassment?

A: The Enron embarrassment was principally the consequence of the activities of key chiefs at the organization, including President Jeffrey Skilling, CFO Andrew Fastow, and organizer Kenneth Lay. These people arranged the deceitful bookkeeping rehearses that expanded Enron’s benefits and concealed its obligation. Moreover, the job of the bookkeeping firm Arthur Andersen, which neglected to identify or report the misrepresentation, was likewise pivotal in the outrage.

Q: What were the legitimate ramifications for Enron’s chiefs?

A: Few top chiefs, including Jeffrey Skilling and Andrew Fastow, were indicted for various charges, including protection misrepresentation, scheme, and insider exchanging. Skilling was condemned to 24 years in jail (later diminished), while Fastow got a 6-year sentence in the wake of helping out examiners. Kenneth Lay, who was indicted however passed on prior to sentencing, was one more key figure engaged with the outrage.

Q: What effect did Enron’s implode have on the energy business?

A: Enron’s breakdown caused critical disturbance in the energy markets, especially in the space of energy exchanging and estimating. The organization’s disappointment prompted a deficiency of trust on the lookout and constrained controllers to fix their oversight of the energy area. Enron’s fall additionally prompted employment misfortunes and expanded investigation of energy organizations’ monetary practices.

Q: How did the Enron outrage lead to changes in U.S. regulation?

A: The Enron outrage prompted the section of the Sarbanes-Oxley Act in 2002, which carried out new guidelines for public organizations, including stricter monetary revealing principles, more free oversight of examining processes, and expanded responsibility for corporate chiefs. This regulation planned to forestall future corporate misrepresentation and further develop straightforwardness in monetary business sectors.

Q: What is Enron’s inheritance today?

A: Enron’s heritage is one of corporate covetousness, monetary extortion, and the requirement for more grounded guidelines in the corporate and monetary areas. Its breakdown exhibited the risks of insufficient oversight, and its story keeps on being a vital illustration of how an absence of morals and straightforwardness can obliterate an enterprise. The Enron outrage stays a significant contextual analysis in business morals and corporate administration.

Conclusion

The ascent and fall of Enron remains as one of the most scandalous instances of corporate impropriety in current history. When considered a titan of development and monetary ability, the organization’s fake bookkeeping rehearses and corporate culture of hazard taking eventually prompted its disastrous breakdown. The embarrassment uncovered the profound imperfections in monetary revealing, corporate administration, and administrative oversight, and left an enduring effect on how organizations are considered responsible.

While the legitimate ramifications for Enron’s chiefs gave a level of equity, the genuine expense of the outrage was borne by many workers who lost their positions and retirement reserve funds, and by financial backers who were hoodwinked by the organization’s deceptive fiscal summaries. Enron’s defeat likewise sent shockwaves through the energy area, prompting expanded guidelines and changes intended to keep such a fiasco from reoccurring.

The tradition of Enron fills in as an unmistakable sign of the risks of corporate voracity and the significance of moral practices in business. It stays a wake up call about the results of overlooking straightforwardness and responsibility chasing benefits. The examples gained from Enron keep on molding corporate administration today, with more grounded monetary guidelines and more noteworthy accentuation on the honesty of monetary revealing. Thus, Enron’s story isn’t simply a section in that frame of mind of corporate misrepresentation yet a continuous example in the significance of morals and responsibility in the corporate world.